- Mar 15, 2023

- 2 min read

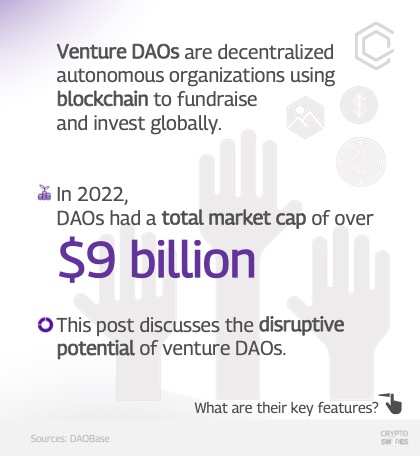

Venture DAOs are taking the finance world by storm! With a total market cap of over $9 billion in 2022, these decentralized autonomous organizations are changing the way we think about fundraising and investing.

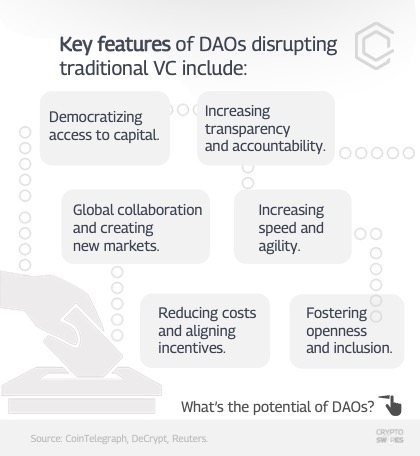

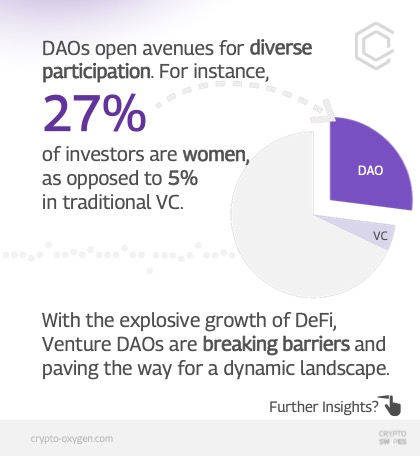

One key feature of venture DAOs is their ability to democratize access to capital. With lower entry barriers, individuals with smaller tickets can participate, creating a more diverse landscape. The average investment size in venture DAOs is $5,000, which allows more people to invest in a variety of projects.

Venture DAOs are achieving higher liquidity of funds, which is disrupting traditional venture capital. For instance, a popular DAO, Uniswap’s treasury now holds about $2.9 billion, indicating the significant value of these organizations.

Another important feature of venture DAOs is their ability to increase transparency and accountability. The blockchain technology used by DAOs allows for a more open and auditable process, which is crucial for building trust and attracting more investors.

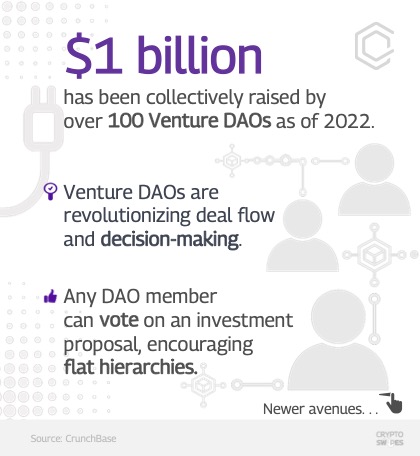

Venture DAOs are also fostering openness and inclusion by creating new markets and increasing global collaboration. With any DAO member able to vote on an investment proposal, these organizations encourage flat hierarchies and diverse participation.

However, regulatory uncertainty remains a challenge, even as venture DAOs revolutionize deal flow and decision-making. As of 2022, over $1 billion has been collectively raised by over 100 Venture DAOs, with Metacartel Ventures being a leading organization with a market capitalization of over $20 million.

Venture DAOs have a disruptive potential that is changing the way we think about finance and investing. They are creating new opportunities for people to invest in a variety of projects, which will lead to a more diverse and inclusive landscape. Join us as we explore this exciting world of global collaboration and new markets!

Comments