- Mar 15, 2023

- 1 min read

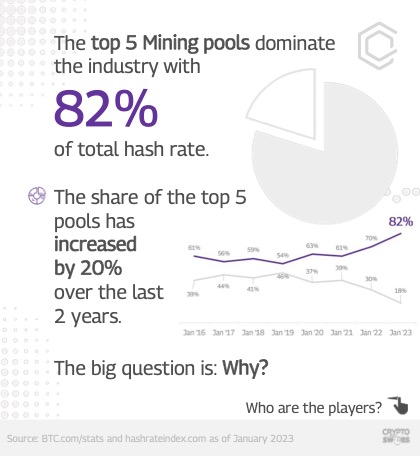

The Bitcoin mining industry is dominated by the top 5 mining pools, which collectively control a whopping 82% of the total hash rate. This means that most Bitcoin blocks are mined by these five pools, making them incredibly powerful players in the industry.

Over the last two years, the share of the top 5 pools has increased by 20%, which begs the question: why are these few mining pools so dominant?

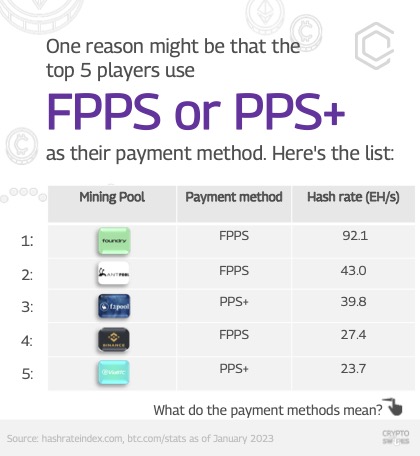

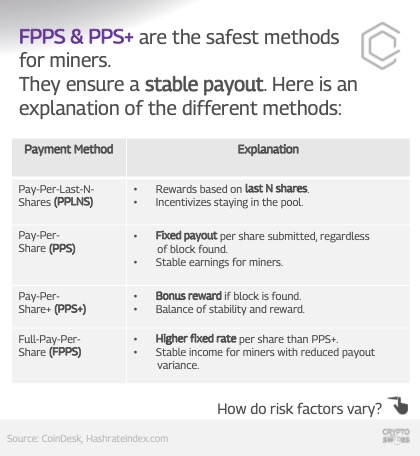

One possible reason is that the top 5 players use Full-Pay-Per-Share (FPPS) or Pay-Per-Share+ (PPS+) as their payment method. These payment methods are considered to be the safest for miners, as they ensure a stable payout regardless of any blockchain reward variance. As risks lie with mining pools, they need to be big to run profitably. The risk management is critical for Bitcoin miners, and they prioritize safety by picking big players. The FPPS and PPS+ methods ensure a stable payout, which is why they are the preferred methods for the majority of mining pools.

Currently, 74.5% of mining pools use FPPS, followed by about 19% of PPS+. These payment methods are riskier for pools, but they are safer for miners, as they guarantee miners‘ share despite blockchain reward variance.

This structure of the mining pool market can make it difficult for small players to enter and compete effectively, leading to a market dominated by a few players. However, it’s worth noting that there are many other mining pools outside of the top 5, and they still play an essential role in securing the Bitcoin network.

Comments